Understanding PU Prime Minimum Deposit Requirements

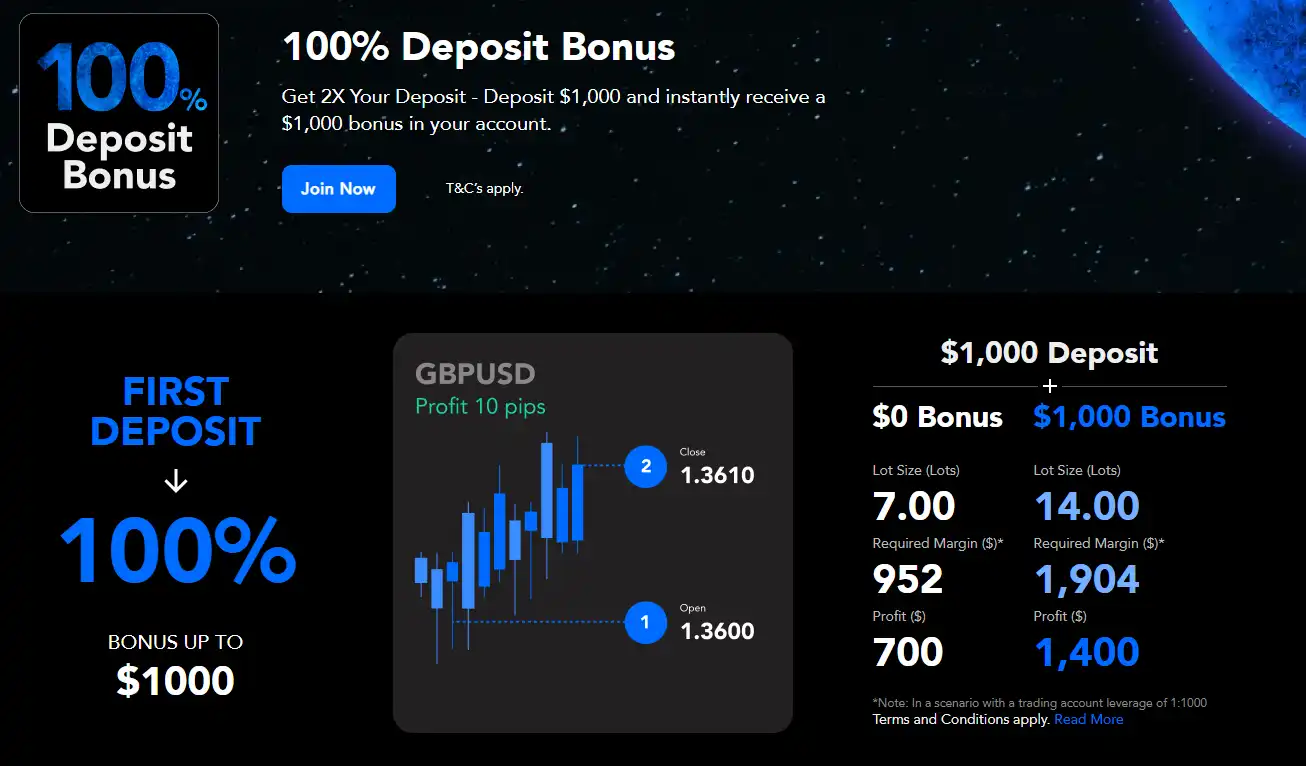

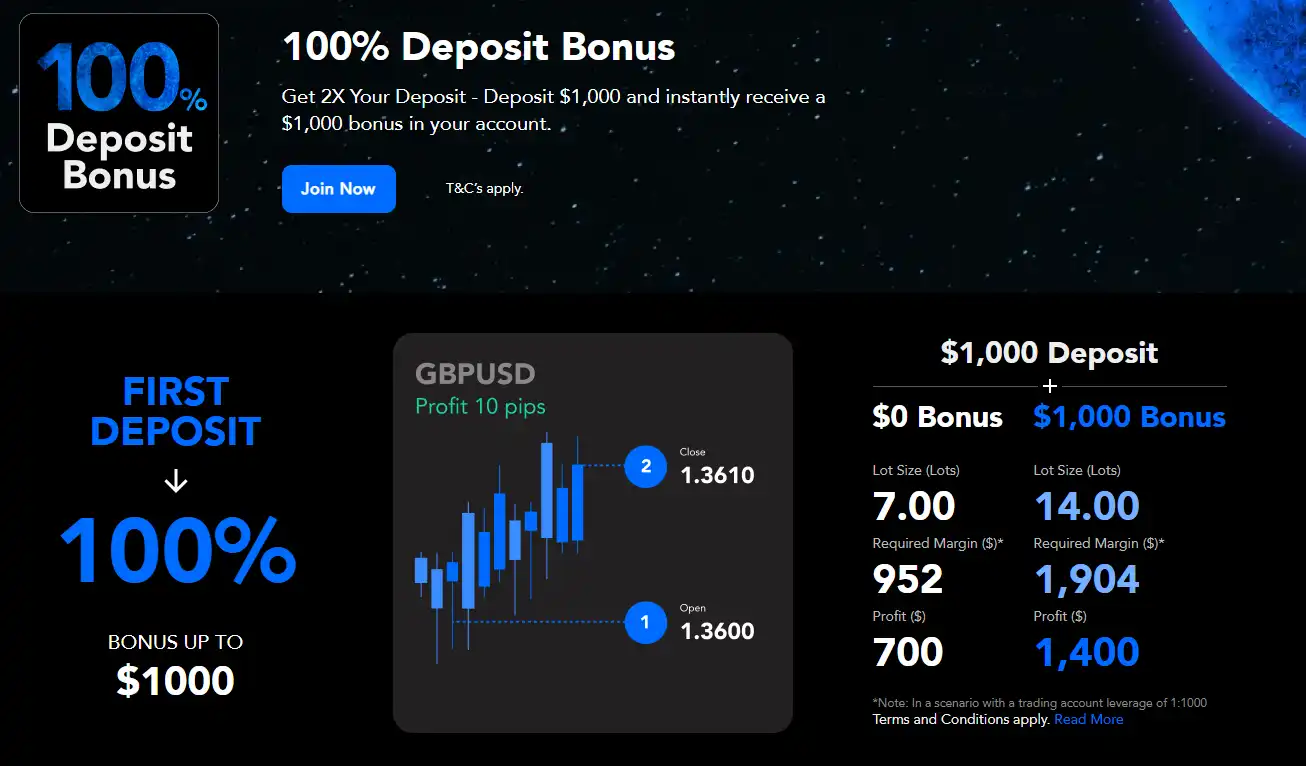

🎁 Claim Your Deposit Bonus Today

Get an exclusive welcome bonus on your first deposit

Our company offers flexible minimum deposit options for Canadian traders seeking to enter the financial markets. PU Prime provides four distinct account types, each with specific deposit requirements tailored to different trading preferences and experience levels.

The minimum deposit structure varies significantly across account categories. Standard accounts require $50 USD equivalent, while Prime accounts demand $1,000 USD minimum. Cent accounts offer the lowest barrier at $20 USD, making them ideal for beginners.

International wire transfers present unique advantages with no minimum deposit requirement. This option provides maximum flexibility for Canadian clients who prefer traditional banking methods. We process these transfers through established banking partnerships across Canada.

Account verification must be completed before making your first deposit. Our compliance team reviews all applications within one business day. Canadian regulations require proper identity verification for all trading accounts.

Available Deposit Methods for Canadian Traders

We support multiple deposit methods specifically designed for Canadian market requirements. Credit cards, debit cards, bank transfers, and electronic wallets provide comprehensive payment flexibility. Each method carries different processing times and minimum amounts.

Credit card deposits process instantly through our secure payment gateway. Visa and Mastercard acceptance ensures broad compatibility with Canadian banking systems. Maximum single transaction limits apply based on card issuer policies.

Bank transfers offer the highest deposit limits for substantial trading capital. We maintain partnerships with major Canadian banks including RBC, TD Bank, and Scotiabank. Processing times range from 1-3 business days depending on the institution.

Electronic Wallet Integration

Electronic wallets provide rapid deposit processing with enhanced security features. Skrill, Neteller, and PayPal integration supports Canadian dollar transactions. These methods typically process within 15 minutes during business hours.

Wallet verification requires linking your Canadian bank account or credit card. Our system automatically converts CAD to your selected base currency using real-time exchange rates. Transaction fees vary by wallet provider and deposit amount.

Cryptocurrency Deposit Options

Bitcoin and Ethereum deposits offer alternative funding methods for tech-savvy traders. Cryptocurrency transactions bypass traditional banking limitations and provide 24/7 processing capability. Minimum amounts start at $25 USD equivalent.

Blockchain confirmations typically require 3-6 network confirmations before funds appear in your account. We monitor network congestion to provide accurate processing time estimates. All crypto deposits convert to your selected base currency automatically.

Step-by-Step Deposit Process

Access your Client Portal using your registered email and password. Navigate to the “Deposit” section located in the main dashboard menu. Select your preferred deposit method from the available options list.

Enter your desired deposit amount in the specified currency field. Our system displays real-time conversion rates for non-USD deposits. Verify the final amount before proceeding to payment processing.

Complete the payment information form with accurate details. Credit card transactions require CVV verification and billing address confirmation. Bank transfer deposits generate unique reference numbers for transaction tracking.

The following deposit workflow ensures secure transaction processing:

- Login to your verified PU Prime account

- Navigate to Deposit section in Client Portal

- Select preferred payment method

- Enter deposit amount and currency

- Complete payment verification process

- Receive confirmation email with transaction details

Currency Conversion and Exchange Rates

Our platform automatically handles currency conversion for Canadian dollar deposits. Real-time exchange rates update every 30 seconds during market hours. We apply competitive spreads comparable to major financial institutions.

CAD deposits convert to your selected base currency at the time of processing. Account holders can choose USD, EUR, or GBP as their primary trading currency. Currency selection affects profit calculations and withdrawal procedures.

Exchange rate transparency remains a priority for our Canadian clients. We display current rates prominently during the deposit process. Historical rate data is available through your account dashboard for reference.

Managing Multi-Currency Accounts

Advanced traders can maintain multiple currency balances within a single account. This feature eliminates conversion costs for international trading strategies. Currency allocation adjustments are available through the Client Portal.

Internal currency transfers between balances process instantly without additional fees. We support up to five different currencies per account. This flexibility accommodates diverse trading portfolios and risk management strategies.

Account Types and Minimum Requirements Comparison

Standard accounts serve as our entry-level offering for Canadian traders. The $50 USD minimum deposit provides access to all major trading instruments. Spreads start from 1.2 pips on EUR/USD with no commission charges.

Prime accounts cater to experienced traders with larger capital requirements. The $1,000 USD minimum unlocks premium features including dedicated account management. Spreads reduce to 0.8 pips with enhanced execution speeds.

Cent accounts offer micro-lot trading with minimal capital requirements. The $20 USD minimum allows position sizes as small as 0.01 lots. This account type is perfect for strategy testing and educational purposes.

Islamic Account Specifications

Islamic accounts comply with Sharia law requirements for Muslim traders. These swap-free accounts eliminate overnight interest charges on positions. Minimum deposit requirements match standard account levels at $50 USD.

We structure Islamic accounts to avoid riba (interest) while maintaining competitive trading conditions. Administrative fees may apply for positions held longer than seven days. This ensures compliance with Islamic banking principles.

Deposit Processing Times and Confirmation

Deposit processing times vary significantly based on your chosen payment method. Credit card transactions typically complete within 15 minutes during business hours. Bank transfers require 1-3 business days for full processing.

Our system sends automatic email confirmations for all deposit transactions. These confirmations include transaction reference numbers and processing status updates. You can track deposit progress through your Client Portal dashboard.

Weekend deposits may experience delayed processing due to banking system limitations. We process all pending transactions first thing Monday morning. Emergency deposits outside business hours are available through select electronic wallet providers.

The following processing timeline applies to Canadian deposits:

- Credit/Debit Cards: 15 minutes to 2 hours

- Bank Wire Transfer: 1-3 business days

- Electronic Wallets: 15 minutes to 1 hour

- Cryptocurrency: 30 minutes to 2 hours

- International Wire: 2-5 business days

Deposit Confirmation and Account Funding

Account funding occurs immediately upon successful payment processing. Your trading balance updates automatically without manual intervention required. Push notifications alert you when deposits complete successfully.

Failed deposit attempts trigger automatic email notifications with resolution instructions. Common issues include insufficient funds, expired cards, or banking restrictions. Our support team provides assistance for deposit-related problems.

Security Measures and Deposit Protection

We implement bank-level security protocols for all deposit transactions. SSL encryption protects sensitive financial information during transmission. Two-factor authentication adds an extra security layer for account access.

Segregated client accounts ensure your deposited funds remain separate from company operational funds. We maintain these accounts with tier-1 Canadian banks for maximum protection. Regular audits verify proper fund segregation compliance.

PCI DSS compliance governs our credit card processing systems. This certification ensures industry-standard security for payment card transactions. We never store complete credit card information on our servers.

Deposit fraud prevention systems monitor unusual transaction patterns. Machine learning algorithms identify potentially suspicious activities. We may request additional verification for deposits exceeding normal account patterns.

Regulatory Compliance and Client Protection

Our Canadian operations comply with all applicable financial regulations. We maintain proper licensing and regulatory oversight for client fund protection. Regular compliance audits ensure ongoing adherence to industry standards.

Client fund insurance provides additional protection for deposited amounts. This coverage protects against operational risks and potential company insolvency. Insurance details are available through your Client Portal documentation section.

Troubleshooting Common Deposit Issues

Deposit failures often result from insufficient account verification. Ensure your identity documents are properly uploaded and approved before attempting deposits. Incomplete KYC verification blocks all funding attempts.

Credit card rejections may occur due to international transaction restrictions. Contact your card issuer to authorize international payments to financial service providers. Many Canadian banks require explicit approval for trading account deposits.

Bank transfer delays typically stem from incorrect reference number usage. Always include the unique reference number provided during the deposit process. Missing references cause processing delays and potential fund returns.

Network connectivity issues can interrupt deposit transactions. Always wait for confirmation emails before attempting duplicate deposits. Multiple transaction attempts may result in unintended account funding.

Technical support is available 24/7 through live chat, email, and phone channels. Our Canadian support team understands local banking systems and common deposit challenges. Response times average under 30 minutes during business hours.

Common deposit problems and solutions include:

- Card declined – Contact bank for international authorization

- Transfer delayed – Verify reference number accuracy

- Wallet rejected – Complete wallet verification process

- Crypto pending – Wait for blockchain confirmations

- Amount incorrect – Check currency conversion rates

❓ FAQ

What is the minimum deposit to start trading with PU Prime in Canada?

The minimum deposit varies by account type, starting as low as $20 USD equivalent for Cent accounts.

Which deposit methods are available for Canadian traders?

Credit cards, bank transfers, electronic wallets like Skrill, Neteller, PayPal, and cryptocurrency deposits are supported.

How long does it take for deposits to process?

Processing times range from instant for credit cards and e-wallets to 1-3 business days for bank transfers.

Are there any fees for currency conversion?

Currency conversion is handled automatically with competitive spreads; fees depend on the payment provider and currency chosen.

What security measures protect my deposits?

PU Prime uses SSL encryption, two-factor authentication, segregated client accounts, PCI DSS compliance, and fraud detection systems.